Humanistic

Wealth Practice

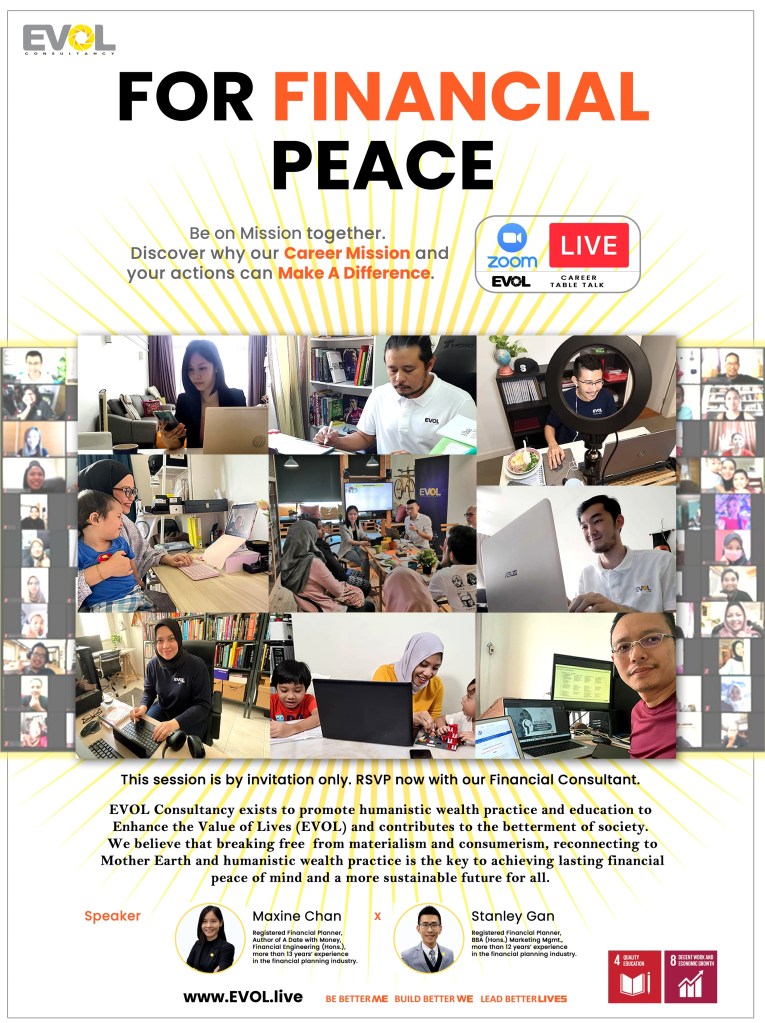

EVOL Consultancy exists to promote humanistic wealth practice and education, and to Enhance the Value of Lives (EVOL) in society.

We believe that breaking free from materialism and consumerism, reconnecting to Mother Earth and humanistic wealth practice is the key to achieving lasting financial peace of mind and a more sustainable future for all.

‘Build Better We’ should be our social currency, the driving force behind ‘Be Better Me’ and the key to building a better environment that ‘Lead Better Lives’. That’s the EVOL way of life.

With our experience as Registered Financial Planners (RFP) and wealth planners, engaging with more than a thousand clients from various backgrounds, we believe the gateway to financial peace of mind is awareness and practice.

Individual EVOL members strive to realise their unique potential and live a way of life that transform themselves and the people around them towards financial peace of mind.

Create a unique and fresh relationship with money

with the help of a Date with Money BOOK!

This engaging, light, and easy-to-read book shows us a new idea about money – how we understand it and connect it with love, time, purpose and health – that can bring more happiness and a better environment into our lives.

EVOL INSIGHTS

My 2026 wealth practice..

What will you do courageously for your wealth practice this…

Peace & Joyous Raya

Wishing you a Peace and Joyous Hari Raya! 🙂 Build…

Which one has better returns? – eBook

With so many investment options, which one has better returns?In…

programS

“How to Refresh Your Budget in a Post-Covid World – Wealth Education Table Talk #56

13 Dec 2022 (Tue) | 08:30 pm – 10:00 pm

– Register Now (By invitation only)

“For Financial Peace: Be On Mission Together” – Career Table Talk

14 Dec 2022 (Wed) | 8:30 pm – 10:00 pm

– Register Now (By invitation only)

Table Talks

Learn how to manage personal finance better through humanistic wealth practice. Join the talk.

EVOL Videos

Build better WE through Wealth Education

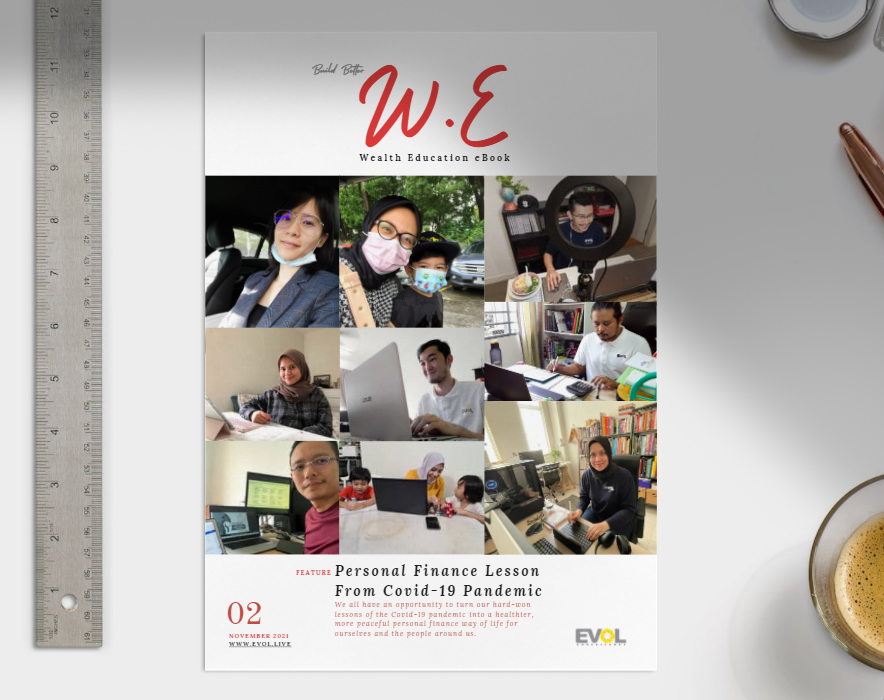

Wealth Education (W.E) eBook features the personal finance story, experience and insights from our financial consultants. It is published specially for our selected clients, Table Talk’s participants and friends, to share hope, joy, financial wisdom and build better we towards personal finance victory together.

One-on-one Consultation

Get quick answers to common personal finance questions through effective financial planning consultation.

Wealth Education

We are sensitising youth across the city about the right way to manage money better at the same time in line with humanistic values by conducting talks to the public.

Join EVOL

If you’re seeking mission-driven associates eager to take on fresh challenges as a team, then you’re a future EVOL Wealth Adviser. Explore EVOL Career.

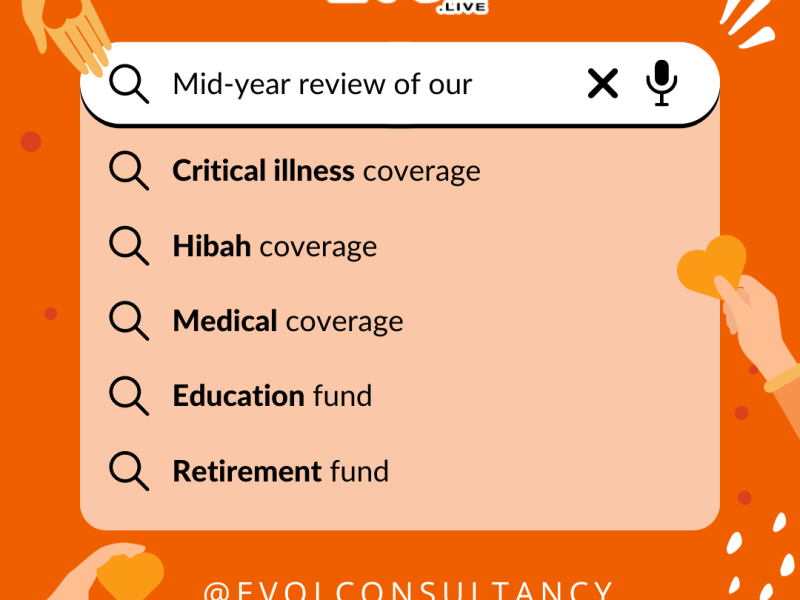

Wealth Planning

Whether you are the head of a family or the key person of a company, we are here to provide comprehensive and customised solutions for your personal and professional financial and insurance needs.

TESTIMONIALS

Interesting & Concise

“It has enough information on what I wanted to know, so it doesn’t bore you into dry topics. Otherwise if I need to find information online, belajar sendiri, faham sendiri.. But it’s good enough, it’s concise, you terus tahu what financial planning is about. All in all this is a very good session!”

— Hani, Social Worker

Help Us to Understand & Utilise Different Options

“Good sharing with different real case study of retirement journey which help us to understand and to utilise different options to secure the retirement plan based on owns requirement.”

— Suet Wee, Purchaser

Made Me Realise to Get Financial Situation In Order

“Such a great session! Learned a lot. This was something I have always wondered but never made an effort to know more about. Thank you to my friend Amirul for inviting me to the talk. It has made me realise to get my financial situation in order as I approach 40 years old! I definitely would recommend this to everyone I know so they at least can start thinking about their finances in a more realistic manner. Thank you!”

— Jelo, TV Production Coordinator

Clear Cut Strategy

“The best part about it is actually the knowledge of financial planning and how you want to do budgeting, that’s the most essential part of our life. It also gives you a clear cut method or strategy on what should you take to have better financial planning.”

— Akmal, Procurement

Ideas That Most Ordinary People Always Looking For

“EVOL team has this genuine approach when sharing the ideas that most ordinary people always looking for in their life. This session resonated me well and beneficial to me as a woman/wife/mom (thank you for this opportunity and experience!) Reason being, I’m always looking for classes/people/team that have a solid understanding about managing financial/health risk in daily life, using relevant and genuine sharing of ideas/thoughts/approaches/techniques with intention to really create the awareness while still pushing the humanity forward and co-elevate others for a better and healthy lifestyle with appropriate financial management system/tools especially for people outside the industry.

I would definitely recommend EVOL table talk to others!”

— Laily, Senior Officer

Actual Study Cases Compiled is Very Helpful

“Credits to EVOL for coming out with such original content and use it to educate us.

The actual study cases compiled is very helpful and they break it down by further analyzing and explaining the why behind the what making it easy for participant to understand the pointer and message. Definitely worth to attend for someone who is looking to start planning for retirement.

Thank you Maxine, Stanley and team.”

— Kok Hwa, HR Executive

Helpful to See Case Studies As Example

“All sessions were equally beneficial but it was helpful to see the case studies as examples.

Biggest discovery was utilizing flexi home loan as “fixed deposit” or reserve fund.

This was my first session so cannot compare. Better than my expectation. Yes definitely recommended.”

— Munirah, Doctor

Things That I Want to Know

“How much is the amount that considered enough, the references, value and guideline are provided by the speakers. It goes in a gradual way to clear up the concept first and then let you know the things that I want to know as reference. I think it’s helpful for me.”

— Jackie, Fresh Graduate

Very Useful Information On The Portfolio Assessment & Gap Analysis

“Very Fruitful session today!! Thanks for sharing the case studies, advices and recommendations. 😊 Especially on the portfolio assessment and the gap analysis. Very very useful information. 👏👏👏”

— Yoke Peng, Assistant Manager

Financial Planning in Detail

“The most beneficial when it spreads out financial planning in detail. I’ve never been to a proper financial planning session, so this is eye opening, and I really love the concept that this session does not entirely about one product, but it could be anything in general, and really focuses on budgeting and financial planning.”

— Afdhal, Graduate Architect

Right Knowledge & Essence

“In my opinion the most beneficial part is the allocation percentage shown on how we should allocate our money in monthly commitment. That was indeed the most hardest part when we do monthly segregation. Through this talk, I learn on how proper budgeting plan can actually help in order for us to plan for future ahead. Sure this discussion surely meet up to my expectation on getting what I can say as right knowledge/essence on building up a proper budget plan from scratch. Thank you EVOL.”

— Norfarahana, Executive

Understand The Purpose of Each Money Saved

“Very friendly and patience to go through my financial report to me, the most beneficial part is understand the purpose of each money saved, and better planning for the saving I have.

The biggest realisation is I think I need to track the records where is my money spent to, so I can have better planning.

Yes, I would recommend Maxine to my friends, as I can feel her passion to her work and try to help people to manage a better financial plan.”

— Siau Yong, Marketing

A Very Solid Picture Which Made Me Confident

“This is my first financial planning session. Stanley and Maxine gave a very clear and detail explanation, which was very easy to understand, and it was up to expectation.

The analysis made me know where do I stand in my financial status now, and also in the future. It paints a very solid picture which made me confident in my life. I also discover that a good financial planning is very important to gain wealth and financial security- rather than blindly pursuing earnings but without proper planning.

I would strongly recommend this meeting to others. Thank you Stanley and Maxine, I gain a lot through the session.”

— Vern Jun, Physician

Made Me Aware of Current Financial Situation

“Thank you Stanley for the one-on-one consultation on the financial roadmap. A very fruitful discussion. This made me aware of my current financial situation. To be honest, it really scared me ![]()

I have a target but can I achieve it later? But from my consultation with Stanley, he did gave me a few points and tips to help me to manage my financial situation. Definitely will repeat this again with him to ensure I on the right track to achieve my financial goals.

So, if you are like me who has a target but still not sure how to manage or achieve it, I recommend you guys to have this one-on-one consultation. ![]() ”

”

— Yaya Zulkeffli, Senior Executive